tn franchise and excise tax guide

The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. FE Credit-4 - Gross Premiums Tax Credit.

Tennessee Franchise Excise Tax Price Cpas

Tax credits offset tax liability.

. ET-1 - Excise Tax Computation. Tennessee Department of Revenue. Franchise Excise Tax - Credits.

1 PDF editor e-sign platform data collection form builder solution in a single app. Tax manuals are intended to be a more comprehensive resource for taxpayers who wish to gain a better understanding of Tennessees mostly commonly applicable taxes. FE-1 - Entity Types that File Franchise Excise Tax Returns.

All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. F. Tennessee Franchise Excise Tax Part II January 20 2022 - 6 minutes read This blog is a continuation of discussion Part 1 posted on 83021 on the various exemptions.

Look through the recommendations to find out which info you will need to provide. Select the form you need in our library of legal forms. All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal year.

Franchise Excise Tax General Information. If calling from Nashville or outside Tennessee you may call 615 253-0700. It is not an all-inclusive document.

Franchise and excise tax components of the quarterly estimates are computed separately. A completed franchise and excise tax return FAE170 must be filed electronically with payment of any taxes due by the 15th day of the fourth month following the close of the tax year. Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated payment is deficient or delinquent up to a maximum of 24 of the deficient or delinquent amount.

Talk to Certified Business Tax Experts Online. FE-2 - Criteria That Must be Met Before There is a Filing Requirement. Choose the Period this should be the filing period end date you want the estimated payment to be credited.

The starting place in computing the excise tax is the net income before loss carryover and special deductions as reported on the federal income tax return such as federal form 1065 1120 1120S 990 T and more. Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting. For more information view the topics below.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Ad Download Or Email FAE 170 More Fillable Forms Register and Subscribe Now. Election made on the franchise and excise tax return.

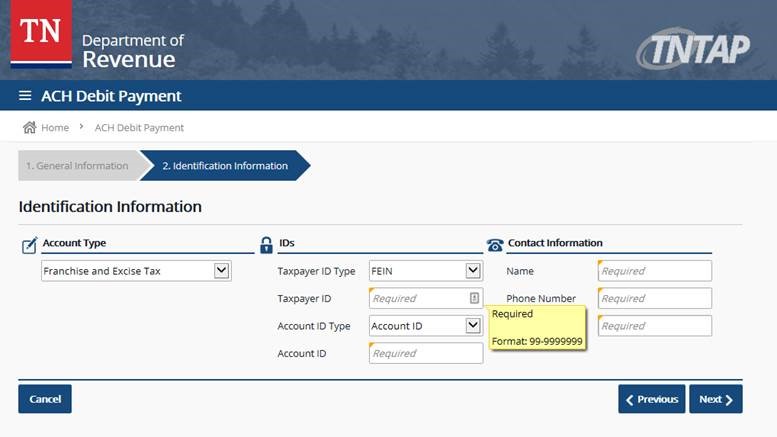

Please look for our next blog which will discuss the FE tax exemptions for venture capital funds and diversified holding funds. For Account Type choose Franchise Excise Tax. 1-800-342-1003 ln State Toll-Free.

Find Reliable Business Tax Info Online in Minutes. ET-1 - Excise Tax Computation. Install the signnow application on your ios device.

These letters identify the account as a franchise excise tax account. Fill in payment details. The tax manuals constitute.

If the federal return is prepared on a consolidated basis a pro-forma single entity return is. Effective May 28 2018 franchise excise tax account numbers now called IDs have been updated from nine digits to 10 digits followed by the letters FAE. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

The number is 800 397-8395. Chat with a Business Tax Advisor Now. Input the Contacts name phone number and email address.

FE-3 - Filing Requirements for Disregarded Entities. Franchise Excise Tax - Excise Tax. This franchise excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee franchise excise tax requirements.

Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121. The Department of Revenue also offers a telecommunications device for the deaf TDD line at 615 741-7398. The Department of Revenue also offers a toll-free franchise and excise tax information line for Tennessee residents.

Excise - computed in accordance with Section 6655e2 of the Internal Revenue Code. If you have questions about Franchise And Excise Tax Online contact. This blog series will cover certain aspects of Tennessees Franchise and Excise tax and give particular focus to the more common exemptions available under the taxing statute.

F. Click on the fillable fields and put the requested details. They are designed to help taxpayers better understand the collection of remittance of select taxes and serve as an informal reference easily accessible via the Departments website.

Open the form in the online editor. Ad 247 Access to Reliable Income Tax Info. ET-2 - Federal Bonus Depreciation is.

Please view the topics below for more information. FE-4 - Tennessee Filing Requirement for an LLC that Files Federally as an Individual or Division of a. Corporation Limited Liability Company Limited Partnership - financial institution or captive REIT Form FAE174 Schedules and Instructions - For tax years beginning on or after 1121.

The tax guide is not intended as a substitute for Tennessee franchise excise statutes or Rules. If you had a franchise excise tax account number before May 28 2018 the only change to this number is the addition a zero. Tennessee franchise and excise tax guide tenn.

Please view the topics below for more information. Fill in the Taxpayer ID Type ID and Account ID. Franchise - the lesser of.

Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years. F. Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated payment is deficient or delinquent up to a.

Fae 173 Instructions Fill Online Printable Fillable Blank Pdffiller

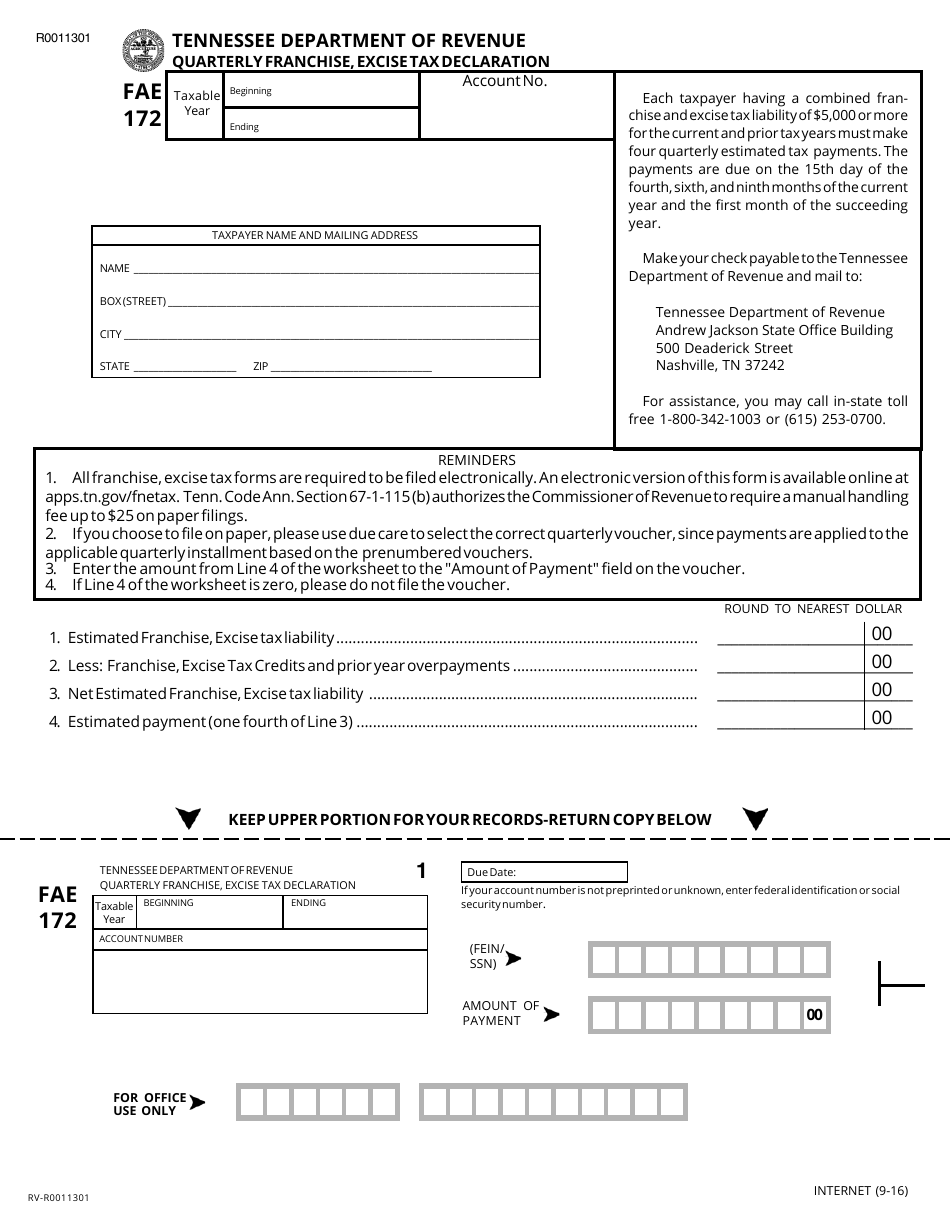

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Tn Fae 170 Instructions Form Fill Out And Sign Printable Pdf Template Signnow

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tennessee Franchise And Excise Tax Form Fill Out And Sign Printable Pdf Template Signnow

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Franchise Excise Tax Consolidated Net Worth Election Applicaion Youtube

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Registering For Tennessee Taxes Using The Tennessee Taxpayer Access Point Tntap Youtube